Experienced Licensed Moneylender & Legal Loan Company in Singapore

We are Credit Empire — Your Dedicated Private Moneylender in Singapore

As a legal moneylender registered with the Ministry of Law’s Registry of Moneylenders, rest assured that all our loans are 100% lawful.

Our promise to you — we’ll never overcharge and will always provide clear, straightforward loan terms, plus solid customer service.

99% approval rate

Simple loan qualification criteria

Transparent interest rate & fees, always

Get cash within 30 minutes

Flexible loan repayment plans

Top-notch customer-centric service

Credit Empire, Your Trusted Moneylender in Singapore

A licensed moneylender in Lucky Plaza, Orchard, Credit Empire can help if you’re looking for a quick, easy and affordable legal loan in Singapore. As an established and authorised moneylender in Singapore, we strive to lend a helping hand to everyone who requires a loan, no matter their nationality or income level.

That’s precisely why any legal loan in Singapore that we provide is always carefully and fairly considered.

We don’t discriminate against borrowers just because they may be earning less than the median income earner in Singapore. We definitely don’t turn potential borrowers away just because they possess a lower-than-average Credit Bureau Singapore credit score!

Credit Empire is proud to be your reliable moneylender in Singapore, always.

Contact us for a free,

no-obligation consultation today!

We’re delighted to assist in any way we can.

Perks of Our Licensed Moneylender Loans

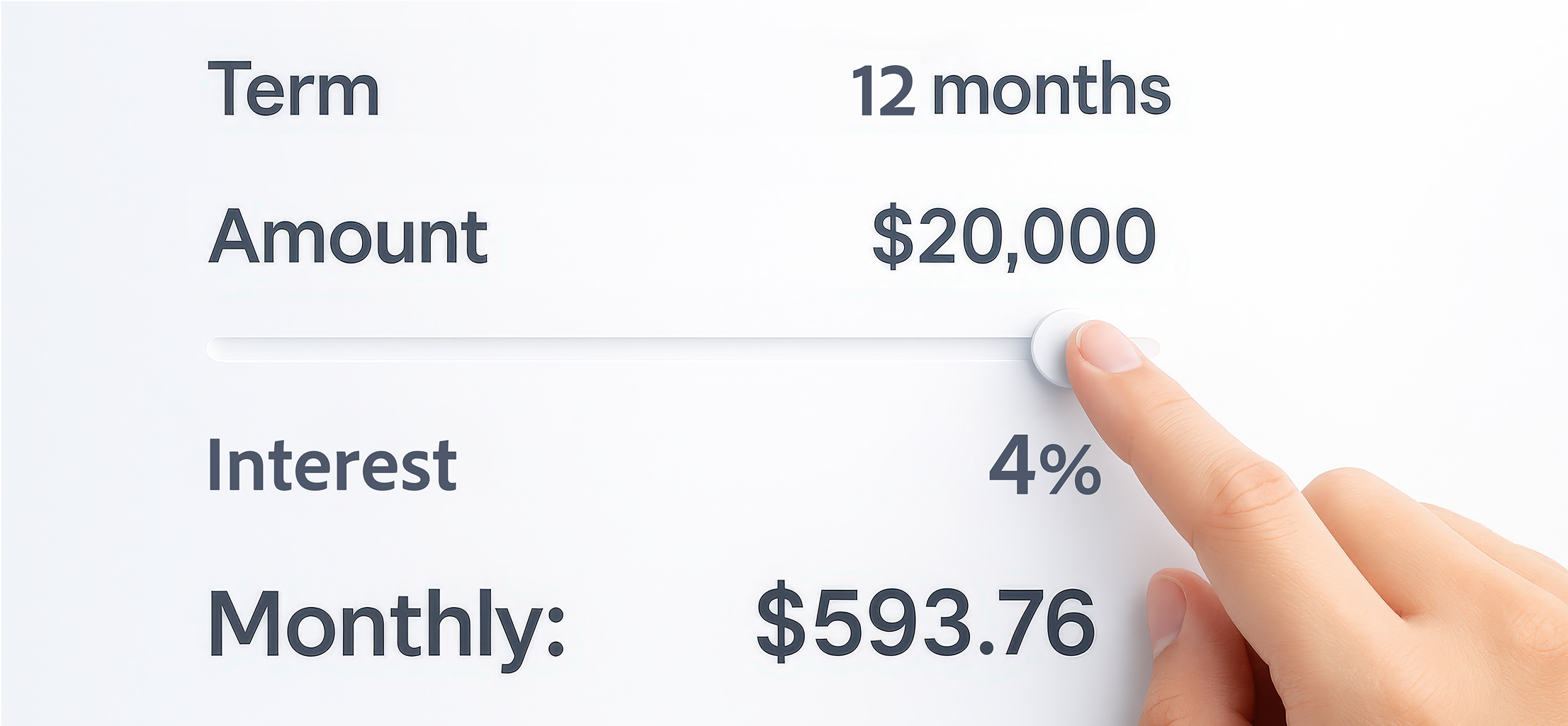

- 3.92% interest & late interest rate: Our rates are lower than the 4% monthly permitted

- No hidden fees and charges: Standardised late repayment fee of $60 & loan processing fee at 10% of approved loan amount

- No collateral needed: Our moneylender loans are unsecured loans

- Flexible repayment terms: Chat with us to help us learn more about how we can assist you; most customers pick a 12-month loan tenure

- 100% tailored loan packages: Your legal loan package is —and should be— as unique as you

- Borrow up to 6X monthly salary: We don’t shortchange borrowers when it comes to loan amounts

- 24 hours moneylender loan application: Simply submit your application on our website anytime*

- Highly accessible legal loans: Singaporeans, Permanent Residents, foreigners and even discharged bankrupts can apply

- Bad credit score-friendly: We believe in second chances and are committed to helping you find a loan solution that fits your existing needs

- Maximum privacy and security: All customers enjoy private consultation areas in our office, and we employ industry-standard encryption to protect your personal information.

You’ll need to visit our office in-person with all necessary documents to complete your moneylender loan application.

Undemanding Moneylender Loan Eligibility Requirements

Minimum age: 18

No minimum salary

No minimum loan sum

Employment status

- Full-time

- Part-time

- Self-employed

- Freelancers, etc

Documents required

- NRIC for Singapore Citizens and PRs, Work Pass for foreigners

- Latest 3 months’ payslips

- IRAS Notice of Assessment or CPF statements (can be retrieved via Singpass)

- Residential proof such as utility bill or tenancy agreement (for foreigners only)

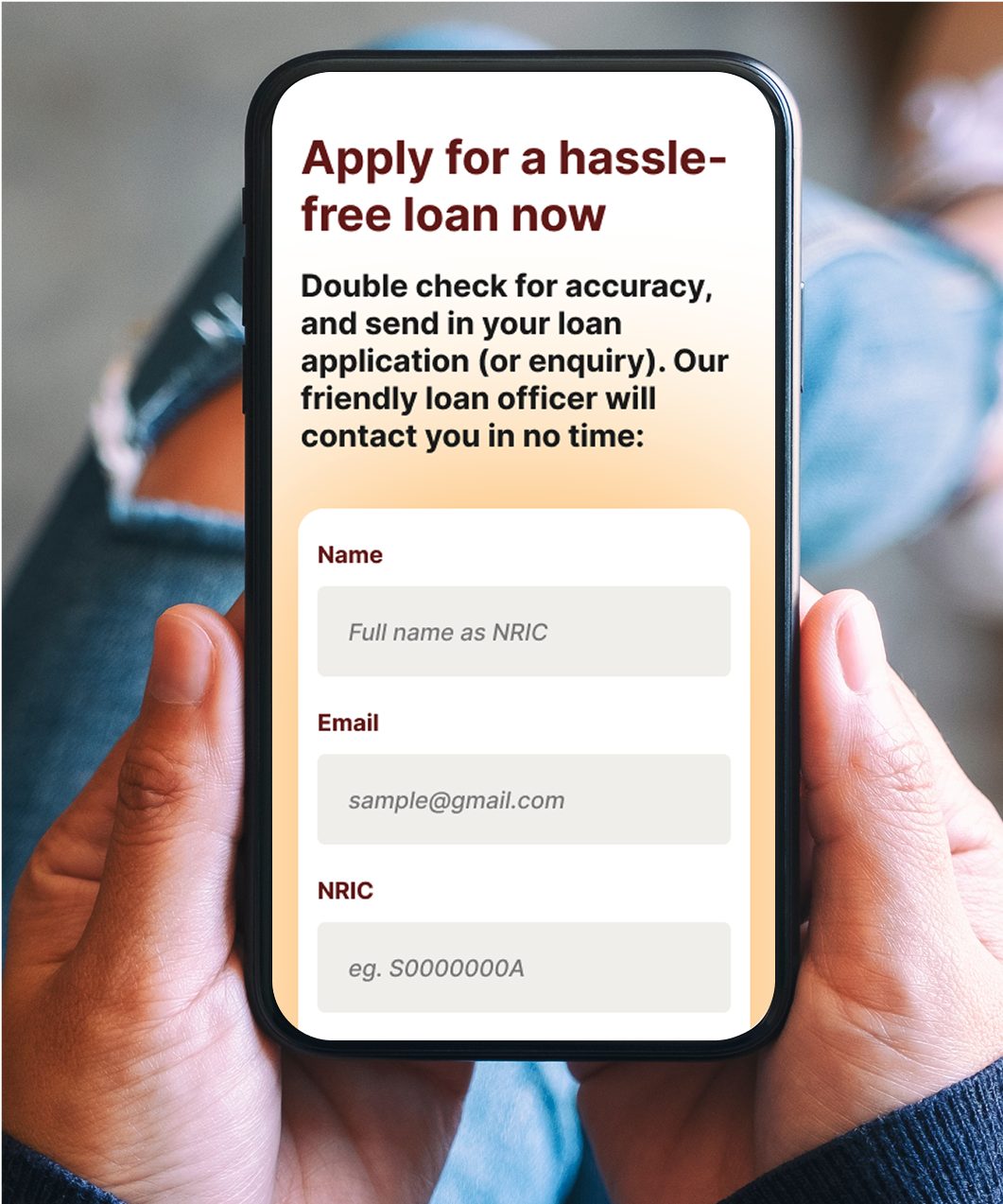

Easy Breezy Legal Loan Application Process

Getting a loan from a licensed moneylender like Credit Empire is a piece of cake. Our moneylender loan application is streamlined and effortless altogether. All it takes is a few simple steps!

- Apply for your moneylender loan online & await our loan officer’s call to arrange for an in-person appointment at our Lucky Plaza moneylender office

- Meet our loan officer with all necessary documents

- Review and negotiate the loan contract; sign off on the contract if agreeable

- Receive your cash immediately

*Note: You may apply for a loan in-person at our Lucky Plaza moneylender office during business hours, too. Bring all your documents along with you for good measure!

Ready to get a legal loan?

Apply with Credit Empire now and get cash in your hands, pronto!

Reasons Why Credit Empire Is Your Reliable Moneylender in Singapore

Prompt, exceptional customer service and support

Whether you’d like to find out more about moneylender loans in general or the nitty gritty details about borrowing from a licensed moneylender, our knowledgeable and courteous customer service team is always here to help at any point of your loan journey — simply reach out via phone, email or chat.

What about online queries submitted through the Credit Empire website? It is our target to respond to these online queries once we receive them for we’re a notable online moneylender in Singapore. Ask away without feeling apprehensive — no question is too small or trivial!

Crystal clear explanation of all loan terms and conditions

As a responsible moneylender in Singapore you can trust, we ensure that our friendly loan officers give you a thorough rundown of all the loan terms and conditions in your loan contract so you get a full understanding of what you are signing up for.

We want to help you get the legal loan you need quickly, but not without first ensuring that you know the interest rates, fees, repayment schedules, monthly instalment amount, and penalties for late payments, etc.

Immediate loan disbursement after loan contract signing

We know how crucial it is for you to get your loan as soon as you can in times of pressing need. That’s why here at Credit Empire, a quick moneylender you can rely on, we offer immediate cash or PayNow loan disbursement right after you’ve reviewed and signed off on your loan contract. We’ll never want to cause a delay, ever.

Multiple repayment channels

We’re more than happy to make things as hassle-free and convenient for you as possible. As one of the top-rated private Orchard moneylenders in Singapore, we offer several repayment channels for you to choose from — cash, bank transfer, and GIRO. Simply let us know your preferred mode of repayment.

Exclusive perks for returning customers

We are pleased to offer a myriad of exclusive benefits for our valued returning customers to thank them for their trust and support.

These perks include a much quicker loan process, a higher loan sum, multiple loans, and more.

Secure online platform that grants customers online access and convenience

We value your time and privacy as much as you do. That’s why we have poured funds into making our online platform secure and convenient for you altogether.

Our secure online platform allows you to easily apply for loans, manage your account, and make payments. It is incredibly easy to use, too.

Drive to help customers make informed money decisions

While we are many folks’ preferred moneylender in Singapore, we don’t just mindlessly offer loans. We also provide resources that guide our customers on making informed financial decisions (i.e. smarter money moves).

Whether it’s budgeting tips, understanding interest rates, or managing debt, we’re here to help you navigate the complex world of money matters.

Customer Reviews of Credit Empire, Singapore’s Trusted Moneylender

Behind The Scenes

How Credit Empire customises unique legal loan packages

Need a quick and wholly personalised legal loan in Singapore?

Apply for one with us today.

Frequently Asked Questions About Private Legal Lenders and Loans in Singapore

What exactly are licensed moneylenders?

Licensed moneylenders in Singapore are legal, authorised businesses that provide loans to eligible individuals and companies. Each licensed moneylender must possess a valid moneylending licence in order to operate. They must fully comply with all rules and regulations pertaining to lawful moneylending, too.

Are licensed moneylenders in Singapore regulated?

Yes, licensed moneylenders in Singapore are strictly regulated by the Ministry of Law’s Registry of Moneylenders. You’ll be pleased to know that licensed moneylenders’ loans are fully legal, and bound by the contractual agreement between both borrower and lender.

Why should you borrow from registered moneylenders instead of illegal moneylenders when you need quick cash?

When you borrow from registered moneylenders, such as from a Lucky Plaza moneylender like Credit Empire, you enjoy a suite of protection on top of the ability to get your loan quickly. Illegal moneylenders are, well, illegal. You risk putting you and your loved ones’ safety and well-being on the line if you get tangled up with illegal moneylenders like loan sharks.

Why do legal moneylenders have such short turnaround times?

Legal moneylenders have short turnaround times and are able to process and approve loan applications because of their streamlined process and minimal documentation requirements. If everything is in order, you can expect to get cash within 30 minutes!

Do licensed moneylenders in Singapore conduct credit assessments?

Yes, as part of their due diligence process, all licensed moneylenders in Singapore are required to do simple credit assessments to determine if a borrower is suitable for taking out a loan. Authorised moneylenders look at the borrower’s Loan Information Report at the Moneylenders Credit Bureau, instead of their Credit Report at the Credit Bureau Singapore.

Do licensed moneylenders have minimum income requirements?

No, licensed moneylenders do not have minimum income requirements that you need to worry about. moneylender loans are very accessible.

Do licensed moneylenders impose minimum loan sums?

Not really. You can simply borrow a small sum of money if that’s what you need. Ethical moneylenders like Credit Empire will never encourage you to take out a larger loan than the sum you need, and can afford to repay comfortably.

What’s the loan amount you can expect when borrowing from licensed moneylenders in Singapore?

There’s no hard and fast rule, really. But, for unsecured loans, you are limited to borrowing up to 6 times your monthly salary across all moneylenders in Singapore at any point in time:

Customer’s annual salary

Singapore Citizens/ PRs

Foreigners

Less than $10,000

$3,000

$500

$10,000 to $19,999

$3,000

$3,000

$20,000 and above

6 times monthly salary

6 times monthly salary

Is it possible to get a moneylender loan with a bad credit score?

Yes, this is possible. Licensed moneylenders don’t put much focus on your credit score, unlike traditional banks and financial institutions. Instead, your ability to obtain a moneylender loan is highly dependent on your current income and employment status. This is most definitely true when you borrow from an Orchard moneylender like Credit Empire.

Is it possible for foreigners to get a moneylender loan?

Yes, foreigners who are working and living in Singapore can get a moneylender loan so long as they are above 18, have a valid Work Pass, a consistent income stream, and can furnish us with all required documents that serve as income and residential proof.

What can you do to increase your odds of getting loan approvals at our legal loan company?

Here are some ways that may increase your chances of getting your legal loan approved at our loan company in Singapore.

Reduce debt-to-income ratio

Lenders often look at the debt-to-income (DTI) ratio to assess a borrower’s ability to repay the loan. Borrowers can improve their DTI ratio by paying down existing debts or increasing their income.

Provide documentation

Being organised and prepared with necessary documentation can make the process smoother. This typically includes proof of income, tax returns, employment verification, and any other financial statements required by the lender.

Consistent employment history

Lenders prefer borrowers with a stable employment history. Having a steady job for a significant period demonstrates reliability.

Avoid major financial changes

Before applying for a loan, avoid making significant financial changes, such as switching jobs, acquiring new debt, or making large purchases that could affect your financial stability.

Be transparent

If there are any issues that may raise red flags (such as past bankruptcies or low credit scores), you should be upfront about these issues and explain your circumstances.

Apply at the right time

Timing can play a role in loan approvals. For instance, applying when one’s financial situation is stable (e.g. after a pay raise) can yield better results.

What types of legal moneylender loans does our loan company in Singapore offer?

Term loan

Bad credit loan

Bridging loan

Wedding loan

Fast loan

Monthly loan

Personal loan

Study loan

Debt consolidation loan

Payday loan

Renovation loan

Business loan

Do legal moneylenders offer secured loans?

Some legal moneylenders offer both secured and unsecured loans, while other legal moneylenders like ourselves only offer unsecured loans. Unsecured loans are great as there’s no need for any collateral.

What’s the interest rate for Credit Empire’s moneylender loans?

Credit Empire’s moneylender loans have an interest rate of 3.92% monthly.

How are licensed moneylenders’ loan interest computed?

Licensed moneylenders’ loan interest is computed using the reducing balance method. All things equal, the total interest will be less than a loan that uses the flat rate method for interest computation.

Do all licensed moneylenders have standardised fees and charges?

Not really. Licensed moneylenders have the liberty to determine their fees and charges for their loan packages so long as these are within legal limits. Here at Credit Empire, we offer a standardised loan processing fee amounting to 10% of your principal loan amount, and a fixed late repayment charge of $60.

Is there a limit on the interest rates and fees legalised moneylenders in Singapore can charge?

Yes. Authorised moneylenders in Singapore can only charge an interest rate of up to 4% monthly for their loans, with the exception of business loans. The limit on late interest rate is also 4% monthly.

As for limits on fees, the maximum loan processing fee allowed is limited to 10% of the approved loan amount. Any late repayment fee that applies for the month the loan is repaid late is limited to a maximum of $60.

In addition, know that no matter how overdue a borrower’s loan repayment(s) may be, the total charges that can be billed to a borrower — comprising interest, late interest, late fees, and processing fees — are capped at the borrower’s principal loan sum.

Do licensed moneylenders in Singapore all offer flexible repayment terms?

Yes, but the degree of flexibility may vary amongst licensed moneylenders in Singapore. Most authorised moneylenders offer loan tenures that go up to 12 months, while some may offer loan tenures as long as 24 months. Chat with us to learn how we, a top rated Orchard moneylender, can help you with your preferred tenure.

Are licensed moneylenders’ loan terms straightforward?

We can’t speak for all licensed moneylenders in Singapore, but here at Credit Empire, we strive to provide you with clear, straightforward loan terms at all times. We also make it a point to fully explain the loan terms and conditions to you so you’re aware of what the loan entails.

Can you visit a licensed moneylender’s office on a public holiday?

Unfortunately, no. Licensed moneylenders’ offices are not open on public holidays. Many legal moneylenders like ourselves are closed on Sundays, too.

Can you pop into a licensed moneylender’s office just to learn more about their services?

Absolutely. Feel free to drop by our Lucky Plaza moneylender office during business hours to learn more about our loan services or clarify any questions you may have. We’re here to help, and our consultations are non-obligatory!

Do legal moneylenders in Singapore have fixed opening hours?

All licensed moneylender offices in Singapore have fixed business hours. If a private moneylender in Singapore claims that they can process and disburse your loan remotely, beware! It is not something that’s permitted under the rules and regulations that legal moneylenders have to follow; you’re probably dealing with an illegal moneylender.

Is Credit Empire a 24 hours moneylender in Singapore?

Although our office isn’t open for business 24/7, you can treat us as a 24 hours moneylender in Singapore as we are a reputable online moneylender in Singapore that allows you to send in your loan applications (or queries) round the clock anytime, anywhere, 24/7. We’ll process your loan application and reach out to you as soon as we can.

Can licensed moneylenders harass borrowers for payment?

Contrary to what some may assume, licensed moneylenders in Singapore are not allowed to harass borrowers for payment at any point. They are free to send friendly payment reminders as deemed necessary.

What happens if you’re unable to keep up with your loan instalments?

We pride ourselves on being your trusted moneylender in Singapore. Do not hesitate to inform us the very moment you find yourself having trouble keeping up with repayments.

While the same cannot be said for all private moneylenders in Singapore, Credit Empire is willing to take steps to mitigate the situation in the event that our borrower faces difficulties in repaying their loan instalments.

Here’s a quick look at what we can do within our loan company’s capacity:

Communication

We’ll typically reach out to you to understand your situation. This could involve phone calls, emails, or letters.

Grace Period

We may offer a grace period after a missed payment during which you can safely make the payment without facing penalties.

Restructuring Options

We may provide options to restructure the loan, such as extending the payment term or temporarily lowering instalment amounts to make repayment more manageable.

Payment Plans

In some cases, we may let you set up a modified payment plan that accommodates your financial situation.

Can legal moneylenders take borrowers to court?

Yes, legal moneylenders have the right to initiate legal proceedings and take borrowers to court in the name of pursuing debts owed by borrowers. However, this is utilised as a last resort. Most moneylenders prefer to negotiate repayment plans and/or restructure borrowers’ loans for good measure first.

What do customers value most about us as their legal moneylender?

Our customers appreciate our high-quality legal loan offerings that meet or exceed their expectations. They are also mighty pleased with the responsive, helpful, and friendly customer support we’re able to consistently provide.

That’s not all. Our customers rank us highly for being reliable, plus they greatly value the easy access to our legal loan offerings, both in-person and online. As a licensed moneylender in Lucky Plaza, Orchard, our office is conveniently located in the heart of Singapore.

Can you lodge a complaint against a legal moneylender?

Yes, you can. If you encounter harassment, intimidation, violence, verbal abuse, or unfair practices or loan terms, do not hesitate to report the legal moneylender — the Registry of Moneylenders will investigate and take appropriate action.